Ah money. It seems like there’s never enough of it no matter how much we earn. We all have that friend with the higher income, nicer house, fancier car, and luxury goods. Longing for everything the Jones’s have is a cold reality of the world we live in. Unless you’re the richest person on earth, the Jones’s will always make more and have more.

You have two options:

- Option 1: keep up with the Jones’s and incur debt

- Option 2: live within your means and learn to be content

This is 100% your choice, and you’ll deal with the consequences of either decision. If you chose option 1, you have lots of nice stuff but are buried in debt.

If you chose option 2, you don’t have all the stuff the Jones’s have, but you’re debt free. Congratulations. Your challenge is to stay debt free and to invest in your future.

If you chose option 1 but wish you chose 2, read on.

How Did I Get Into Debt?

According to a survey conducted by Harris Poll, most people incur debt due to unnecessary purchases they can’t afford, aka keeping up with the Jones’s. Other reasons include paying for emergency expenses and purchasing necessities during times of unemployment. All these reasons could have been avoided by budgeting and building an emergency fund. Whatever the reason, debt happened. It’s time to get out of debt.

Getting Out of Debt

Step 1: Calculate Annual Interest Payments

Gather statements from the past month from any debt incurring accounts (other than your mortgage) to include:

- Credit Cards

- Car Loans

- Student Loans

- Home Equity Loans

- Miscellaneous Loans (other than mortgage)

Add up the interest charges from all these statements and multiply by 12. This number is your annual cost of debt. It’s basically money you’re giving someone else to be in debt :-/

Next, add up all the payments you made on these accounts and multiply by 12 again. This is the extra money you’ll have in your pocket each year IF you pay off these accounts. These calculations are important for motivating you and for helping you realize why you’ll want to stay out of debt once debt free.

Step 2: Track Your Spending

Writing a budget is necessary for getting out of debt, but you won’t know where to cut back if you don’t know where your money is going. The easiest way to track your spending is to use one checking account and debit card to pay for all expenses. At the end of the month, categorize and total each expense (food, utilities, gifts, clothing, etc). Some banks have a feature that allows you to download your statement as an excel file, which simplifies this step if you know how to use excel.

The amount spent in certain areas may surprise you. When Josh and I tracked our spending, we found that he was spending $600 a month on food, and I was spending $500. We were spending $1,100 a month on food for two people! Tracking our spending quickly changed our food buying habits.

Step 3: Write Your Budget

Writing out a budget is a multi-step process that is too lengthy for a single blog post. I’ll keep it basic for now, but I do have plans to expound on this topic in the future. Subscribe below to get updates on future articles!

Spending usually falls into one of four basic budget categories: necessities, debt pay down, luxury, or convenience.

- Necessities: bare bones items and services needed for survival. Necessities are the CHEAPEST option to meet the need. Anything more expensive than the cheapest option would be considered luxury or convenience.

- Debt pay down: debt payments above the minimum required amount. This category will eventually turn into savings once your debts are paid off.

- Luxury: extra items/services that are not necessities or items/services that are necessities but are more expensive than need be.

- Convenience: items or services that save you time.

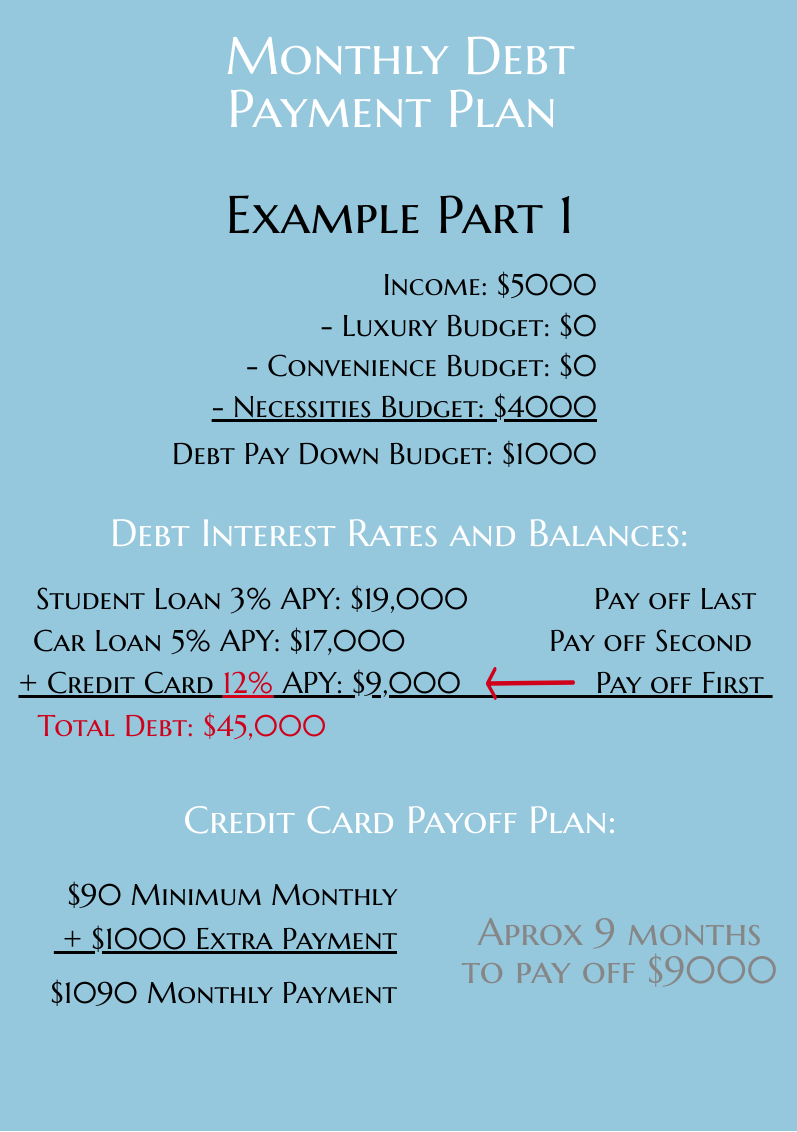

First, determine how much money you need to spend to survive. This is your necessities budget. Don’t include any luxuries or conveniences. If your necessities cost more than your income, you need to make some major changes (like downsizing your home or car) or increase your income.

Second, determine how much you want to spend on luxury and convenience. This amount can be zero if you’re serious about becoming debt free. If you have a high income and a busy lifestyle, it may be worth it to pay for convenience every once in awhile. Luxury tends to be optional.

Josh and I realized that most of our $1,100 food expense went toward convenience (fast food and prepackaged groceries) and luxury (fine dining and Starbucks). We were able to decrease our food expense from $1,100 to $500 once we realized how much we were spending.

Third, it’s time to plan paying off your debt. Take your income and subtract your necessities, luxury, and convenience budgets. The remainder is your debt pay down budget. Make minimum payments on each account, and use the debt pay down budget to pay off the highest interest rate account first. When that account is paid off, use the the extra money to pay off the next highest interest rate account. Keep this going until all the accounts are paid off.

Step 4: Follow Your Budget

Now that you have a budget, you need to stick to it. Keep using the same checking account and debit card to pay for all your expenses. Categorize and total all purchases at the end of every week according to your budget. If you realize you’re spending too much, cut back in the following weeks or make changes the following month if it’s too late to cut back during the current month.

What About a Savings Budget?

Building an emergency fund is SO important for financial health. Dave Ramsey recommends saving at least $1,000 before paying down any debts, then paying off all debts (other than your mortgage) before saving more or investing.

The $1,000 savings builds discipline and gives you a slosh fund to work with in case you ACCIDENTALLY go over your budget. This is a great technique that has worked for many people. You can use your debt pay down budget to build your $1,000 savings before you start using it to pay down your debts.

However, based on your financial situation, it may be better to invest before paying down low interest rate debts. Bankrate.com has a great article that addresses what you need to consider when deciding whether to save or pay off debts. They suggest that if the interest rate of your debt is higher than the return rate of your investment, pay off the debt first. If the return rate of the investment is higher than your debt’s interest rate, it might be wiser to go for the investment.

Both are great techniques that have solid reasoning behind them. Do your research and do what makes sense for you.

After you’re out of debt, the next step is to STAY OUT OF DEBT! Subscribe below to receive notifications on upcoming articles. The next two I have planned are on decreasing spending and getting organized.

Heya i am for the first time here. I found this

board and I find It truly useful & it helped me out

a lot. I hope to give something back and aid others like you aided me.