Disclaimer: This method requires time. It isn’t a get rich quick scheme.

Millennials…they want instant gratification and everything handed to them on a silver platter, right? Wrong. I’m a millennial and am living proof that we can be patient and hard working, just give us a chance! Many millennials are still in their 20s and can benefit from the guidance of older generations. I know I certainly did.

Savings 101

When I first started my career, my supervisor taught me this saving technique. He was a Gen-Xer, and I wouldn’t be where I am financially if it hadn’t been for his mentorship. Usually, he would task us with busy work: organizing binders, running errands, etc. One day, our task was completely different. He had us figure out how much money we would save in 10 years if we saved half of our raises each time we got one. The result took me by surprise and forever changed my saving habits.

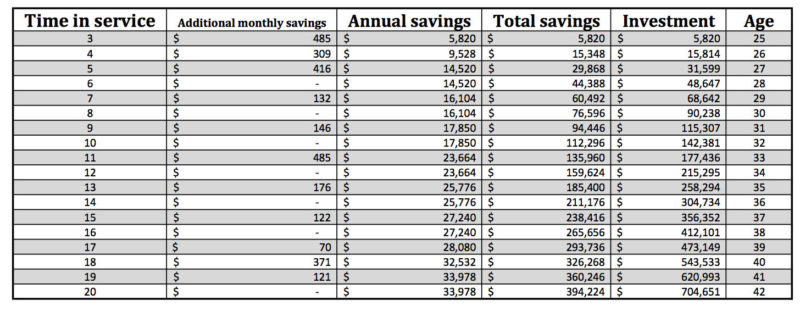

The total amount? Over $112,000! By the end of the 10th year, we would be saving nearly $18,000 annually. His reasoning behind this technique is simple. You’re used to a certain standard of living. When you get a raise, there’s no need to spend all of it. You know you can survive off of your current paycheck, but it also isn’t realistic to think that your expenses will remain the same your entire life. So, save half of your raise and reward yourself with the other half.

Financial peace and opportunity

Living below your means isn’t easy. It’s tempting to spend what you earn; you worked hard for it! However, financial peace of mind is worth the sacrifice. You won’t have to worry about emergency expenses, and you’ll have the chance to take advantage of investments when the opportunity arrises, which contributes even more to your wealth. For example, when the housing market bottomed out in 2012, it was a great time to invest in real estate, but you could only invest if you had the cash to do it. A $50,000 investment could have doubled or even tripled in 5 years depending on the area. Opportunities like that don’t come around very often, but when they do, you can only take advantage of them if you have the cash. Cash = opportunity.

Another benefit of having substantial savings is that you don’t need to take out loans for large expenses. In time, you will be able to pay for a car, a dream wedding or a down payment for a home in cash without changing your lifestyle. Paying in cash will save you hundreds, even thousands in interest expenses.

But I don’t have a 6 figure salary, how will this work for me?

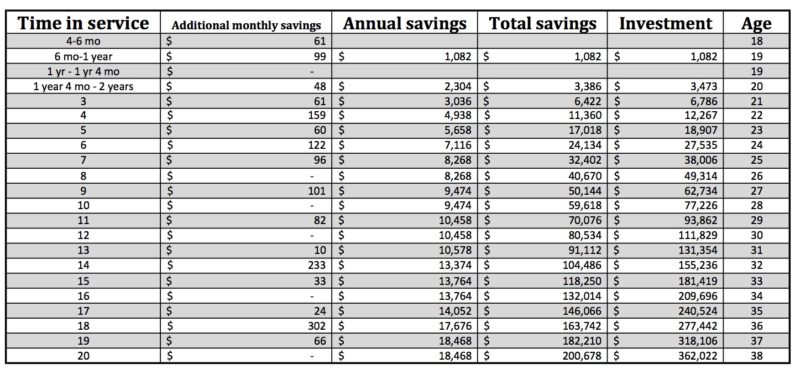

All jobs and pay scales are different. It might take a bit longer and a bit more sacrifice to reach $100,000, but the opportunity is still there. I applied this savings technique to the military officer (college degree required) and enlisted (no degree required) career paths. I used this career as an example because its promotion and raise timeline is fairly predictable and because it’s the career path I’m most familiar with. Using this saving technique, the enlistee will out-save the officer through age 30. If the enlistee puts their savings into an investment account with an 8% return, the account will grow to $111,000 by age 30, and the account will outperform the officer’s investment account until age 34!

The ability for the enlistee to outperform the officer shows the power of compound interest and the advantage of investing at a young age. At age 33, the enlistee would have invested a total of $118,250, while the officer would have invested $135,960 (see “Total savings” column in chart 1 & 2). The officer would have contributed $17,710 more to their investment than the enlistee ($17,710=$135,960-118,250). However, the enlistee would have $181,419 in their investment account, while the officer would only have $177,436 (see “Investment” column in chart 1 & 2). So although the enlistee spent $17,710 less than the officer on the investment, they are $3,983 richer! This happens because the enlistee had invested since age 18, while the officer started at 25. The enlistee had an additional 7 years for the money to grow.

Although I use the military pay scale in this example, the principles remain the same and the method of saving can be applied to any career. Investing consistently at an early age is key. Now, there is no investment account (that I know of) with a guaranteed 8% return rate. All investments have risk, but an 8% growth rate over a long period of time is a reasonable expectation.

According to MIT, the average living wage for a single adult living in Sacramento, CA is $23,930 per year. Living wage is the amount of money required to pay for food, housing, medical care, child care, transportation, miscellaneous expenses, and taxes. If you deduct housing, food and medical expenses (the military pays for these), the living wage decreases to $9,888. If you’re single, living on an enlisted salary while still saving money is totally possible! It just takes discipline.

But I’m not in the military, and I make minimum wage!

This is a much more challenging situation. After college, I wasn’t able to immediately start my career and found it difficult to find a well paying job. It took almost 2.5 years after graduating for my career to kick off. As part of the boomerang generation, I ended up moving back in with my parents until I was able to find a roommate and a job. The church I attended knew I needed a job and offered me one that paid minimum wage. I was very thankful and accepted their offer. I eventually moved on to waiting tables and retail. Sometimes I had two jobs at once. It’s tough. I understand. Saving $1,000 is nearly impossible on minimum wage, and saving $100,000 is outright impossible.

My advice is this: live as frugally as possible while working one full-time job. Move in with family if you can. Don’t get a second job if you can help it. Instead of getting a second job, use your off time to enhance your skills.

Let me end this section by saying this, there is nothing wrong with having a minimum wage job. It’s respectable work, and I highly respect those that are working hard for minimum wage. However, if you DO want to get out of earning minimum wage, you need to become more valuable to employers. This means either furthering your education or showing that your are capable of taking on more responsibility. Showing up on time, having a good attitude, practicing good ethics, and doing your best DON’T COST A CENT! In time, you will set yourself apart from your peers and advance. I have faith in you and believe you can do it!

Rae, I don’t believe you. Show me the numbers!

Officer Chart

Includes the following assumptions:

- The officer saves half of his/her base pay raise. By raise, I’m talking about raises due to an increase in time in service or promotion. Savings do NOT include annual pay raises approved by congress (the 1-3% pay increase service members get each year), bonuses, incentive pay, housing allowances, sustenance allowances, taxes, or TDY pay. Anything saved from these additional income sources is a bonus!

- Pay is based off of the proposed 2018 pay charts found here.

- The “Investment” column assumes the annual savings is deposited at the end of the year into an account with an 8% growth rate compounded annually.

- The officer commissions at age 22 and promotes based on the following schedule:

- O-2: 2 years time in service

- O-3: 4 years time in service

- O-4: 10 years time in service

- O-5: 17 years time in service

Enlisted Chart

Includes the same assumptions as the officer chart with the enlistee entering service at age 18 (without any college education) and promoting based on the following schedule:

- E-2: 6 months time in service

- E-3: 1 year 4 months time in service

- E-4: 3 years time in service

- E-5: 5 years time in service

- E-6: 13 years time in service

- E-7: 17 years time in service

Life is a series of choices. In the example above, the non-college grad (enlistee) was able to save more money than the college grad (officer) initially. However, the college grad ended up with the larger investment account in the end. Attending college is a very personal choice and requires a lot of sacrifice. It requires time, money, and the forfeiture of several years of pay. Although I think college has may benefits, I don’t believe that college is the right choice for everyone. Doctors make way more money than me, but I don’t think I should go to med school just because of the increase in pay. Our situations are all different. This comparison shows the ability to make the most out of either situation and end up a financial success. Best of luck in your financial endeavors.

That’s it? How can I learn more?

I recommend the books “Total Money Makeover,” by Dave Ramsey and “Rich Dad Poor Dad,” by Robert Kiyosaki. Both have shaped my financial habits. For more, check out my blog on reducing debt using the snowball method. Also, visit The Wealth Hound’s blog for more great financial tips!

Great post! I am a big fan of Dave Ramsey as well, and have taught his Financial Peace University course. We all need to think smarter with our money!

Thanks Gator! I’ll have to look into that course. It sounds interesting! Did it take a lot of time/resources to teach the course?

I just finished taking the Dave Ramsey FPU course a few weeks ago, Ryan bought me the Rich dad, poor dad book… 8 years ago? They have both totally changed the financial aspect of my life. To teach the course, took 10 weeks, not hard, just watching videos 45min-1hour long and answering questions/ filling out workbook. Definitely worth it, if the goal is to help others find financial peace 🙂 great blog, keep up the good work!

Author

Thanks Melissa! I’m going to look into it!